On-line training for women e-entrepreneurs

-

Module 1 What is entrepreneurship8 Topics|1 Quiz

-

1.1. Introduction to entrepreneurship

-

1.2. Basic principles of entrepreneurship

-

1.3. Types of entrepreneurship

-

1.4. Differences between entrepreneurship and e-entrepreneurship

-

1.5. Entrepreneurial thinking

-

1.6. Entrepreneurial skills

-

1.7. Challenges and opportunities women face in entrepreneurship

-

1.8. Ethical aspects in entrepreneurship

-

1.1. Introduction to entrepreneurship

-

Module 2 From idea to business7 Topics|1 Quiz

-

Module 3 Digital Marketing10 Topics|1 Quiz

-

3.1 Marketing research and marketing plan

-

3.2 Digital Marketing

-

3.3 S.E.O. (Search Engine Optimization)

-

3.4 Social media marketing

-

3.5 PPC – Google AdWords

-

3.6 Web Analytics

-

3.7 Mail Marketing

-

3.8 Internet of Everything

-

3.9 How to build your website

-

3.10 Effectiveness of a digital marketing strategy

-

3.1 Marketing research and marketing plan

-

Module 4 Business Networking6 Topics|1 Quiz

-

Module 5 Fund-raising & financing6 Topics

-

Module 6 Presentation of an e-entrepreneurial project (pitch)3 Topics|1 Quiz

-

Annex

5.3 Different types of funding

Every business has different needs and starting point, and no solution fits all business ideas. Your personal financial situation and vision for your business will give you the main lines for the financial future of your business. This is also why financing planning is so important. Once you have your plan ready you can start planning where and how you will get funding. New entrepreneur almost always needs outside capital from external financiers. As a small business owner, you may have many options to choose from when it comes to the different types of business financing. Each type of funding comes with its own set of requirements, and other criteria that may make one a better fit for your financial situation and repayment abilities than others.

Self-funding

Self-funding can come in the form of turning to family and friends for capital, using your own savings accounts. With self-funding, you retain complete control over the business, but you also take on all the risk yourself. You need to consider how much you are ready to spend / invest and can you afford it.

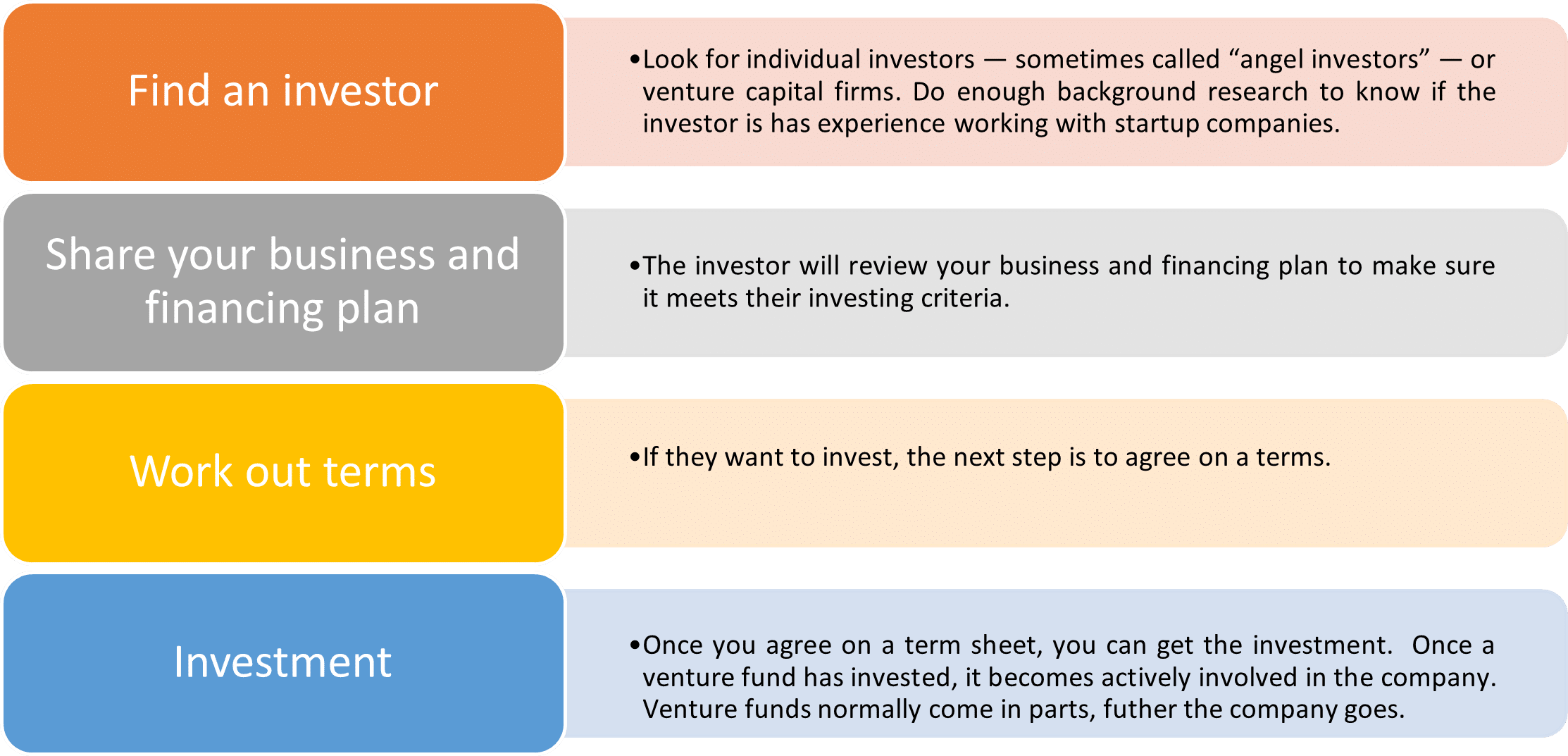

Venture capital from investors

Investors can give you funding to start your business in the form of venture capital investments. Venture capital is normally offered in exchange for an ownership share and active role in the company. Remember to ask yourself, how much power of the company are you ready to give away?

Venture capital is somewhat different from traditional financing. Venture capital typically:

- focuses high-growth companies

- invest capital in return for equity, rather than debt (this is not a loan)

- might be higher risk in exchange for potential higher returns / profit

- has a longer investment horizon than traditional funding

If venture capital is used as funding, get ready to give up some portion of both control and ownership of your company in exchange for funding.

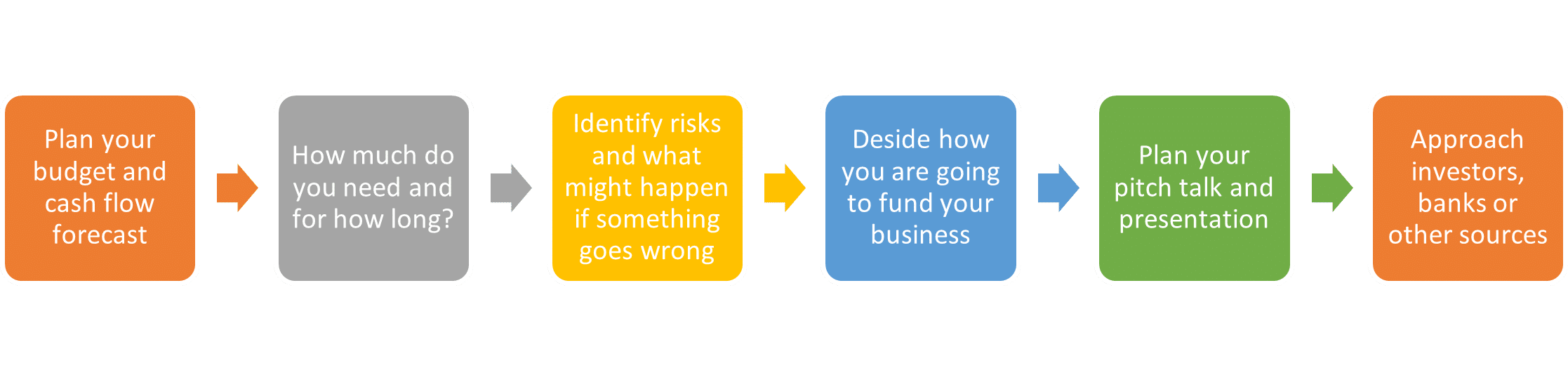

Basic steps in venture capital are:

Crowdfunding

Crowdfunding raises funds for a business from a large number of people, called crowdfunders. Crowdfunder aren’t technically investors, because they don’t receive a share of ownership in the business and don’t expect a financial return on their money. Crowdfunding is quite popular because it is very low risk for business owners. Crowdfunding gives you to retain full control of your company. Every crowdfunding platform is different, so make sure to you understand everything also your full financial and legal obligations.

Bank loan

Banks lend money for startups. Bank loans generally carry lower interest rates than loans from online lenders Some countries have programs that guarantee some portion of startup costs for new businesses so banks can lend them money with the government, reducing the banks’ risk. In some cases, your business has to have hard assets it can pledge to back up a business loan. Banks look very carefully at these assets and your financing plan to make sure they reduce the risk. The need for collateral also means that most small business owners have to pledge personal assets, usually house equity, to get a business loan.