On-line training for women e-entrepreneurs

-

Module 1 What is entrepreneurship8 Topics|1 Quiz

-

1.1. Introduction to entrepreneurship

-

1.2. Basic principles of entrepreneurship

-

1.3. Types of entrepreneurship

-

1.4. Differences between entrepreneurship and e-entrepreneurship

-

1.5. Entrepreneurial thinking

-

1.6. Entrepreneurial skills

-

1.7. Challenges and opportunities women face in entrepreneurship

-

1.8. Ethical aspects in entrepreneurship

-

1.1. Introduction to entrepreneurship

-

Module 2 From idea to business7 Topics|1 Quiz

-

Module 3 Digital Marketing10 Topics|1 Quiz

-

3.1 Marketing research and marketing plan

-

3.2 Digital Marketing

-

3.3 S.E.O. (Search Engine Optimization)

-

3.4 Social media marketing

-

3.5 PPC – Google AdWords

-

3.6 Web Analytics

-

3.7 Mail Marketing

-

3.8 Internet of Everything

-

3.9 How to build your website

-

3.10 Effectiveness of a digital marketing strategy

-

3.1 Marketing research and marketing plan

-

Module 4 Business Networking6 Topics|1 Quiz

-

Module 5 Fund-raising & financing6 Topics

-

Module 6 Presentation of an e-entrepreneurial project (pitch)3 Topics|1 Quiz

-

Annex

5.1 Financing plan

There are common startup costs you’re likely to have. In this list you can find some examples of the costs / you may have when starting your company:

- equipment and supplies

- communication – data fees

- utilities

- insurance, accountant, bank fees

- inventory

- advertising, marketing, printed materials

- salaries

- making a website

Once you have identified your business expenses and how much the total cost is, you should organize your expenses into one-time expenses and monthly expenses. Onetime expenses are the initial costs needed to start your business. Buying equipment, supplies, hiring a website designer, and paying for permits are generally considered to be onetime expenses. Remember that financing must cover running the business and living as an entrepreneur sometimes several months after starting before you get income. The assets cover everything that will be necessary to start your new business. Depending on your business idea these needs vary. You also can short your expenses as necessary (must-have) and discretionary (nice-to-have). Decide are there some costs you can move to future or maybe eliminate.

Financing usually consists of the company’s equity and liabilities. The company’s financial structure thus describes the ratio of equity to liabilities as a share of the company’s total capital. The liabilities are the resources you have access to finance your needs. They can be personal (personal funds, investors, subsidies) or borrowed (startup money, bank loan etc.).

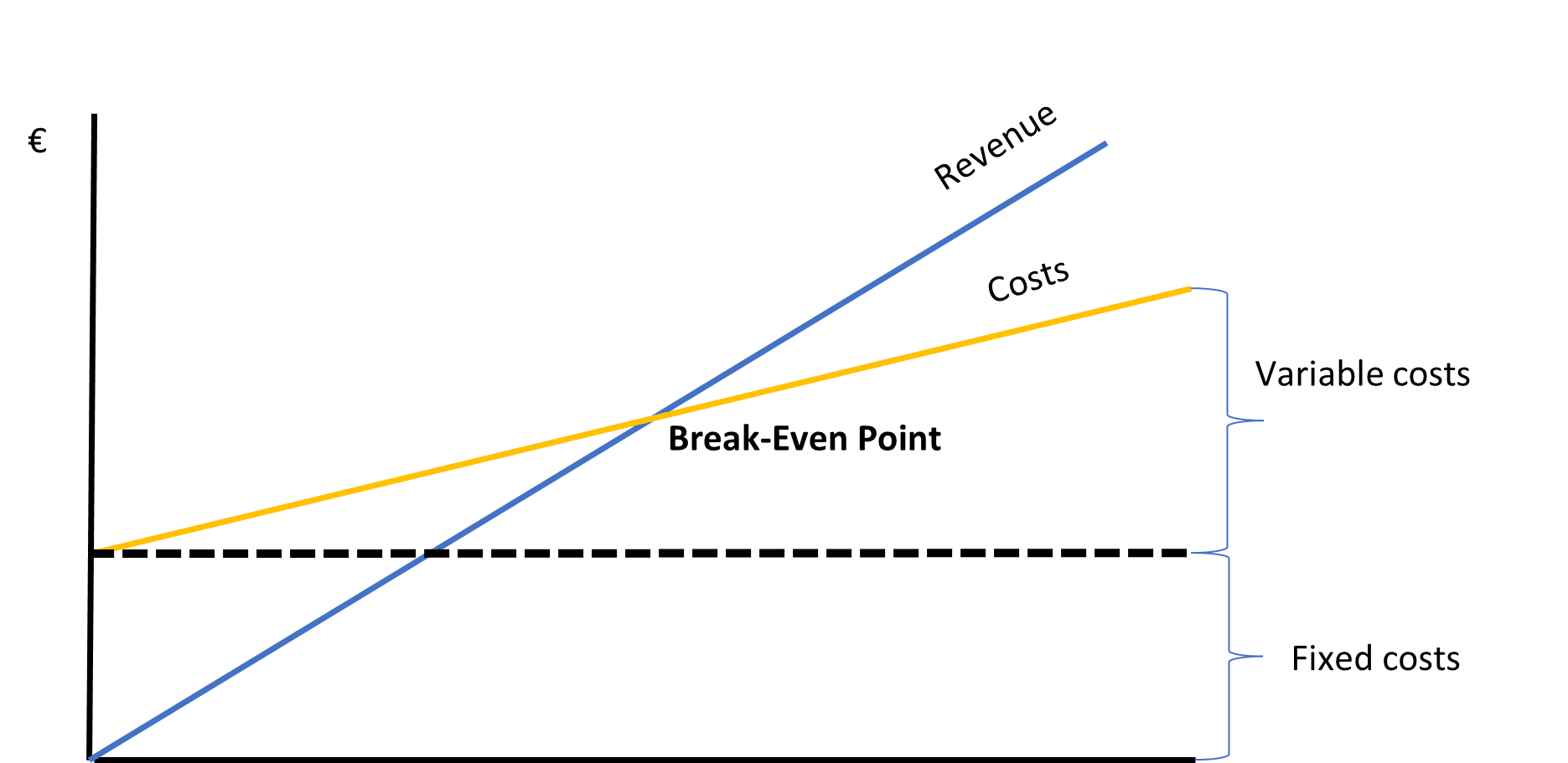

The expenses cover all the costs associated to the business over a month or a year. Break down each expense where possible so you understand the big picture. We can classify the expenses in two categories:

- Fixed costs: These are expenses that you will have to pay in case regardless how much your income is. Typically, the rent, the salaries, social contribution, the accountant, the repayment of the loans are fix costs

- Variable costs: These are expenses that vary according on how much you will sell. Mainly it will be the purchase of stock, shipping cost, income taxes ect.

The break-even point is the point where a company’s revenues equals its costs. The calculation for the break-even point can be done one of two ways; one is to determine the amount of units that need to be sold, or the second is the amount of sales that you need. The break-even point allows a company to know when it, or one of its products, will start to be profitable. If a business’s revenue is below the break-even point, then the company is operating at a loss. If it is above, then it’s operating at a profit. Break-even point gives you a goal that you need to reach on your sales.

Value Added Tax (VAT) is a consumption tax that is applied to nearly all goods and services that are bought and sold for use or consumption in the EU. Rules may be applied differently in each EU country. In most cases, you have to pay VAT on all goods and services at all stages of the supply chain including the sale to the final consumer. This includes from the beginning to the end of a production process, e.g., buying components, transport, assembly, provisions, packaging, insurance, and shipping to the final consumer. Find out more information on your country VAT rules.