On-line training for women e-entrepreneurs

-

Module 1 What is entrepreneurship8 Topics|1 Quiz

-

1.1. Introduction to entrepreneurship

-

1.2. Basic principles of entrepreneurship

-

1.3. Types of entrepreneurship

-

1.4. Differences between entrepreneurship and e-entrepreneurship

-

1.5. Entrepreneurial thinking

-

1.6. Entrepreneurial skills

-

1.7. Challenges and opportunities women face in entrepreneurship

-

1.8. Ethical aspects in entrepreneurship

-

1.1. Introduction to entrepreneurship

-

Module 2 From idea to business7 Topics|1 Quiz

-

Module 3 Digital Marketing10 Topics|1 Quiz

-

3.1 Marketing research and marketing plan

-

3.2 Digital Marketing

-

3.3 S.E.O. (Search Engine Optimization)

-

3.4 Social media marketing

-

3.5 PPC – Google AdWords

-

3.6 Web Analytics

-

3.7 Mail Marketing

-

3.8 Internet of Everything

-

3.9 How to build your website

-

3.10 Effectiveness of a digital marketing strategy

-

3.1 Marketing research and marketing plan

-

Module 4 Business Networking6 Topics|1 Quiz

-

Module 5 Fund-raising & financing6 Topics

-

Module 6 Presentation of an e-entrepreneurial project (pitch)3 Topics|1 Quiz

-

Annex

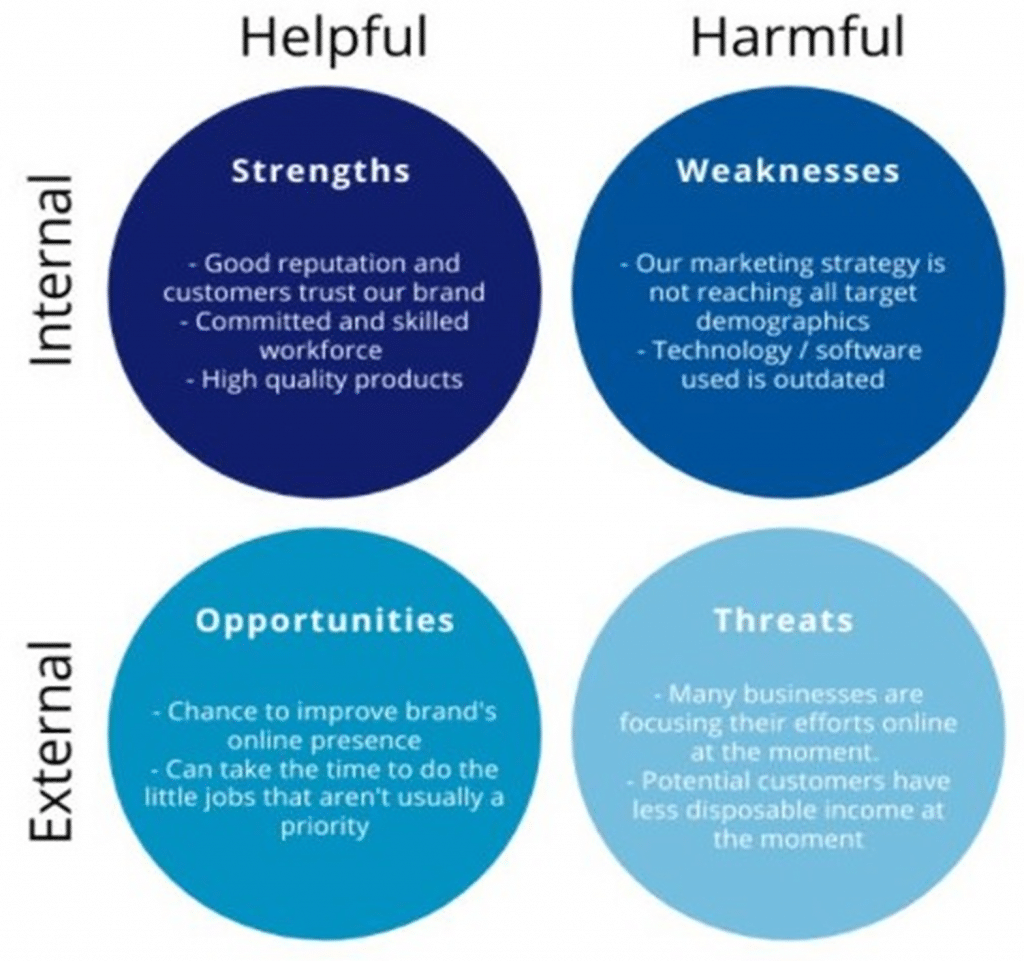

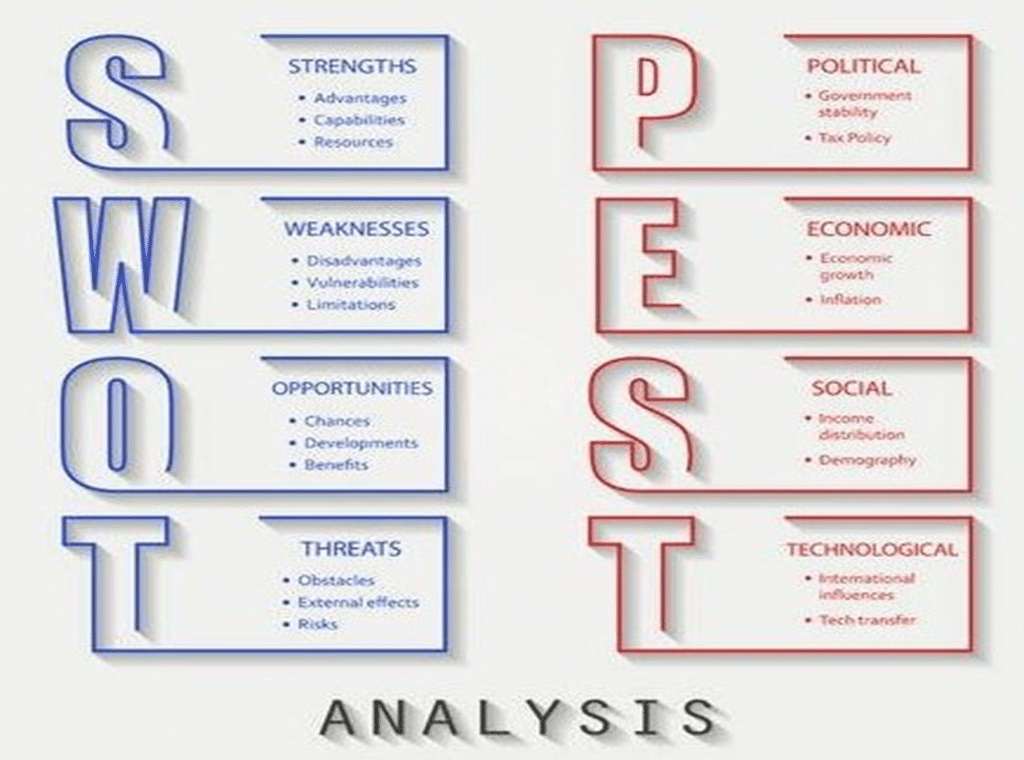

2.4 Business Plan (SWOT Analysis – PEST Analysis)

In the initial phase, it is necessary to carry out a first verification of the feasibility of the business idea, proceeding, if necessary, to a first review of the idea itself before venturing into the market. Later, what you will have learned in this phase will be very useful for tackling the last stretch of the path, the most difficult: the drafting of the business plan.

To verify if your idea is feasible it is necessary to analyze it in detail and measure its risk.

There is no business without risk: the danger of something going wrong is connected to the very idea of setting up your own business. If the risk cannot be eliminated, it can nevertheless be calculated.

At this stage it is highly advisable to carry out a first “internal analysis”, which allows to:

- assess the “strengths” and “weaknesses” of the business idea (risk factors);

- estimate the degree of overall risk.

In the initial phase, when evaluating the aptitudes to set up the business, you faced with subjective factors, that is, your personal characteristics. Now you must instead take into consideration all those factors that objectively affect the success of your business.

By carrying out an initial feasibility analysis, it will be possible to proceed – before actually starting – to all the necessary “corrections”. To this end, it is necessary to analyze different risk areas, which may vary according to the different sectors of activity.

It is therefore necessary to request the SWOT or the analysis of strengths and weaknesses and threats and opportunities, a crucial analysis to identify the most appropriate improvement strategies.

S.W.O.T. analysis is the acronym for Strenghts, Weaknesses, Opportunities, Threats.

The aim of this technique is to analyze the impact of the main internal and external factors of the company that influence the positioning compared to the competition with the aim of developing a competitive and differentiation strategy. It is therefore necessary to distinguish two types of analysis:

- Internal

- External

With regard to internal analysis, the company must precisely identify its strengths and also its weaknesses. This is because the strategies must focus on the possibility of reinforcing the strengths and eliminating, or at least mitigating, the negative effect of the weaknesses. Instead, with the external analysis the company must identify all those factors that come from the external environment that can be considered opportunities or threats to their business.

1) Analysis of internal factors

The strengths are all those skills and competences that differentiate the company from its competitors and are clearly perceived by consumers as well. Leveraging these points involves the consolidation of the company’s positioning with the achievement of good performance. To identify the strengths, the following questions can be answered:

- What do I do best?

- What kind of knowledge do I have that competitors do not have?

- What resources can I have?

- What benefits do my customers attribute to me?

Weaknesses, on the other hand, are those characteristics that limit success and they must be carefully analyzed in order to eliminate or mitigate their effects. To identify the weaknesses, the following questions can be answered:

- What am I unable to do?

- What know-how do I lack?

- What resources am I lacking?

- How is my competitor better than me?

Let’s make a non-exhaustive list of areas in which strengths and weaknesses can be identified.

Areas in which you can identify your strengths and weaknesses:

- Technological knowledge

- Image

- Availability of financial resources

- Specialised personnel

- Organizational structure

- Consumer perception

- Market awareness

- Technology

- Production and distribution (logistics)

2) Analysis of external factors

Threats are all those trends in the external environment that negatively affect the success of the company. These factors must be foreseen in order to avoid them or mitigate their effects. To identify external threats, the following questions can be answered:

- Is my market trend changing?

- Are competitors implementing strategies that harm me?

- Does new technologies threaten my product?

- Has the cost of borrowing and financing increased?

Opportunities, on the other hand, are all those trends in the external environment that can bring advantages to the company, such as the introduction of new legislation, social changes and consumer tastes, positive phases of the economic cycle, development of new technologies, local events advantageous to you. To identify opportunities, the following questions can be answered:

- Are there any new social trends in place?

- Is disposable income increasing?

- Have laws been enacted that are beneficial to me?

- Does technology open new frontiers for me?

Let’s make a non-exhaustive list of areas in which threats and opportunities can be identified.

Areas in which to identify threats and opportunities

- Economic trend

- Legislation

- Social changes

- Technological innovation

Observing the SWOT it should be noted that if read vertically STRENGTHS/OPPORTUNITIES – the positive aspects – are highlighted, while the combined WEAKNESS/THREATS represent the negative aspects. Furthermore, STRENGTHS and WEAKNESSES represent the present and the past, while OPPORTUNITIES and THREATS represent the future.

3) Strategies

After these considerations it is possible to identify for example the following strategies:

- STRENGTH/OPPORTUNITY: leveraging internal strengths and exploiting external opportunities.

- STRENGTH/THREATS: use strengths to defend against threats.

- WEAKNESSES/OPPORTUNITIES: eliminate internal weaknesses and take advantage of external opportunities.

- WEAKNESSES/THREATS: activate defense strategies in order to prevent external threats from aggravating internal weaknesses.

Many companies also conduct a PEST analysis together with a SWOT analysis.

A PEST analysis works in a very similar way to a SWOT analysis, only it deals with four factors that are totally external to the company. Here are the factors of a PEST Analysis:

- Political Factors

- Economic Factors

- Sociocultural factors

- Technological Factors

The PEST analysis provides you with a structure that allows you to investigate the external environment of your organization, it prompts you to ask yourself what are the external factors of greatest impact on the organization and to discuss likely implications:

- What are the key political factors?

- What are the important economic factors?

- What are the most important cultural aspects?

- What technological innovations could occur?

- What current and upcoming legislation could affect the sector?

- What are the environmental considerations?

How you categorize each issue raised is not important when using the PEST technique because the purpose of this tool is simply to identify as many factors as possible.

For example, it is not important to classify an upcoming government regulation as a political or legal issue. The only thing that matters is that it is identified as potentially having an impact on your organization.

The PEST tool is a powerful technique for analyzing your environment, but it should only represent one component of a comprehensive strategic analysis process. PEST factors, combined with external microenvironmental factors and internal drivers, can be classified as opportunities and threats in a SWOT analysis.

It is recommended to use PEST analysis to study external scenarios when it is necessary to make some fundamental decisions for the life of an organization, such as:

- when planning the launch of a new product or service

- when new market strategies are being explored

- when you start selling in a new country or region

In all these cases, it is necessary to evaluate the potential impact of external factors on your organization, both from an operational and a market point of view.

The purpose of the PEST analysis is to identify problems that meet two key criteria:

- They are beyond the control of your organization

- They will have some level of impact on it

All discussions need to be carefully controlled to keep the focus on identifying problems rather than trying to solve them. You will need to consider the implications of all the factors you identify, but you need to avoid falling into the trap of discussing possible solutions or strategies.

The process you will likely take when using the PEST technique is relatively simple:

- Brainstorm and list key issues that are beyond the control of the organization.

- Identify the implications of each problem.

- Evaluate its relative importance to the organization (eg, critical, broad, important, significant, moderate, or insignificant).

- Assess the likelihood of it occurring (eg, certainty, extremely probable, probable, potential, remote possibility or will not).

- Consider briefly the implications if the problem has already occurred.

This process should give you a much clearer understanding of your environment. This vision of the “big picture” allows you to evaluate the potential risks that must be faced and the impact that current external factors will have.

In the most recent version, the PEST analysis has been updated in PESTEL analysis by adding the following external factors:

- Ecological Factors

- Legal Factors

One of the main reasons why PESTEL analyzes are worth looking into is because many of the factors that might end up in a PESTEL matrix might also be relevant to the opportunities and threats in your SWOT analysis. The health, political and economic turmoil sparked by the COVID-19 pandemic we witnessed around the world in 2020, for example, very well represents a set of legitimate and serious threats to many businesses (plus some opportunities).

These types of obstacles tend to be much more complicated than the opportunities and threats that can be found in most SWOT analyzes. Given their larger scale and complex social, national or even global repercussions, they need specific, analytically and professionally conducted analysis.

SWOT analysis provides more immediate and potentially actionable roadmaps, while PESTEL analyzes can be of great value when it comes to formulating longer-term business plans and business strategies.

Short video going further on SWOT ANALYSIS (duration 6 min 27 sec)

and PEST (duration 2 min 42 sec)

Once you’ve decided to take the plunge, you need to figure out how to make money from it. In other words, you need to figure out what your business model is. There are lots of questions that fall under this: who is your target customer? What problem are you trying to solve? What’s your cost structure? What’s your profit margin? When your business model is figured out, it’s time to write up a business plan.

The business plan is a document of fundamental importance for the new entrepreneur.

A well done document:

- allows you to verify the real feasibility of the initiative under its various profiles (technical, commercial, economic, financial);

- constitutes an operational guide for the first management periods;

- represents an irreplaceable business card for any contact with potential investors (it is also required by many financing laws for new businesses).

The business plan determines, with reasonable approximation, the degree of convenience and risk of the initiative, and it gives a rational answer to two basic questions:

1) is it worth to start the business? And, if the answer is yes,

2) what is the best way to make it happen?

But how is a business plan built?

A business plan consists of three basic parts:

- the first part, an introduction;

- the second part, of a technical-operational nature;

- the third part, of a quantitative-monetary nature.

The first part of the business plan, the introduction:

- briefly describes the business idea and how it was born and developed;

- refers to subjective factors: it must highlight the personal characteristics (attitudes, aspirations, motivations) and professional (studies carried out, work experience, technical skills, etc.) of the persons involved.

The credibility of the aspiring entrepreneur is extremely important: therefore the business plan have to provide, in its first part, a significant profile of the owners.

You have to highlight those personal qualities that can constitute real arguments for the success of the initiative: know-how, leadership attitudes, organizational and creativity skills, ability to work in a team, to deal with people, etc.

Just introducing yourself is not enough. You also need to offer a clear and convincing picture of what you want to do and how and where you want to do it.

The second part, therefore, refers to objective factors and must specify the technical and operational feasibility of the project.

In this part you have to describe in detail:

- the product or service;

- the production tools (technologies, plants, machinery, etc.) and the process of producing goods or providing services;

- the environment in which you plan to operate (competitors, suppliers, commercial intermediaries, etc.) and the market in which you plan to sell (customers);

- the company structure (legal form, number of employees, organization, location, etc.).

But it is not enough to have clear ideas about what you want to do and how. You also need to know how much money it takes to achieve your goals and what profits your future business can guarantee.

It is therefore necessary to highlight:

- the financial resources provided for investments (own resources, any subsidy provisions, any bank or external investor loans, etc.);

- expected profits and when they will begin.

The reliability of the information and data reported in this part of the project is very important.

Now you have to demonstrate the data set out in the technical-operational part of the business plan. To do this, your project must be “translated” into quantitative-monetary terms, through a series of balance sheets and income statements.

These have to identify, over a period of at least three years, the extent of:

- investments: “activities” or “uses of resources”;

- financing: “liabilities” or “sources of resources”;

- income: result of the financial statements, which can be positive (“profit”, when revenues exceed costs) or negative (“loss”, otherwise);

- cash flows (difference between monetary inflows and outflows recorded in a given period).

At this point, the path becomes – for most of us – extremely difficult. In fact, the preparation of the budget is a process characterized by an intrinsic technical complexity and requires in-depth knowledge of accounting.

We limit saying that the construction of the budget involves the drafting of:

- partial estimates: they relate to each company function (production, commercial, administrative, etc .: production estimate, marketing estimate, investment estimate, etc.);

- the global budget (ie relating to the company as a whole).

Once the partial estimates have been drawn up, these converge in the summary estimates – economic estimate, financial estimate, asset estimate – which formally represent long-term estimates and which constitute, as a whole, the global budget.

We said that the pre-feasibility analysis allows you to broadly measure the degree of risk you face. Obviously, a well done business plan is much more precise and it indicates the “dark areas” of your idea. And this allows you to fix problems even before having fired the first shot, that is, before the start-up phase (the actual start of the new business).

All corrections, as we know, always proceed by trial and error. The business plan, in fact, is not defined from the start, nor it is immutable. On the contrary, it constitutes a sort of “work in progress”, characterized by the need for constant verification, revision and adaptation of the starting hypotheses.

Creating a business is, therefore, a gradual process, to be followed step by step. First at the project level, then with everyday work. For this reason the budget is also known as a “pro forma budget”: this expression indicates precisely that it is a non-definitive draft, a work in constant evolution; at least until the simulation of the company in the first three years shows the lowest possible risk level.

Here you can find a video with more detailed information on how to write a business plan (duration 13 min 38 sec)